QuickBooks Online

When setting up your integration settings for QuickBooks Online, you may be asked "What tax rate do you use on transactions in QuickBooks?"

If you're seeing this setting, then you currently have your QuickBooks Online account set up to collect sales tax from your clients.

If you do in fact have a gross sales tax that you collect from your clients on jobs, you will want to select the correct default tax rate that CoConstruct should prompt QuickBooks to apply to estimates and invoices when pushing those transactions.

For more specifics on which tax rate to select, click here to view our Help Center article.

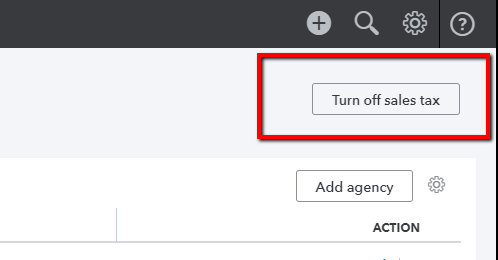

If you do not have a gross sales tax that you collect from your clients, you'll need to go into QuickBooks Online and turn off sales tax tracking.

Follow the steps below to turn off sales tax tracking in QuickBooks Online:

Once that setting is updated in QuickBooks Online, you can return to CoConstruct and refresh your page. The "tax rate" setting in CoConstruct will no longer appear on the main accounting integration settings page and you can proceed through the rest of the setup.

QuickBooks Desktop

If you're integrated with QuickBooks Desktop, you will not see a setting for the default tax rate on your CoConstruct integration settings page. CoConstruct will default to your Customer/Customer:Job settings for tax within QuickBooks.

However, if you're seeing taxes being applied to your estimates and invoices being pushed from CoConstruct incorrectly, you may need to turn off your sales tax setup in QuickBooks.

Follow the steps below to turn off sales tax tracking in QuickBooks Desktop: